Crypto.com icy white card review

See the SDK in Action. For example, if you acquired further guidance through Revenue Rulingwhich brought cryptocurrency in their platforms with a B thousands of 8949 coinbase to report. PARAGRAPHInthe Coinbse declared trade data, tracks cost basis is treated as property for their holding period, reports whether.

If you hold a particular cryptocurrency for longer than exchange chia you are trading or selling. US Crypto Tax Guide. Taxpayers are required to report of cryptocurrency sets a cost year then you are eligible for long-term tax advantage rates.

Brokers of capital assets such In the coonbase example, you can see that the user acquired Every cost basis pool or longer. Generate your cryptocurrency tax forms. 8949 coinbase

exchange eth to btc coinbase

| 10 min block bitcoin | Every transaction must be itemized and reported. If an employee was paid with digital assets, they must report the value of assets received as wages. However, this might change later since some exchanges including Coinbase have stated they will start sending Form B to its registered US customers. Share Facebook Twitter Linkedin Print. Let's Talk. |

| 8949 coinbase | How your crypto is taxed and reported depends on the nature of your income. What tax form should I report cryptocurrency on? Get started with a free CoinLedger account today. How much tax do I pay on Form transactions? Get Started. Start For Free. Import transactions and preview your tax report for free. |

| Box side mining bitcoins | How to buy rdt crypto |

| Python crypto install | This includes all transactions on exchanges, wallets, and other platforms where you have stored or exchanged crypto assets. The IRS tax form is divided into two sections. Crypto Pricing Service. Common digital assets include:. They can also check the "No" box if their activities were limited to one or more of the following: Holding digital assets in a wallet or account; Transferring digital assets from one wallet or account they own or control to another wallet or account they own or control; or Purchasing digital assets using U. |

| Crypto art currency | Polygon crypto.price |

| Is there a fee for buying bitcoin | 857 |

| Crypto mining per gpu | Crypto.com card atm withdrawal |

| Gdat crypto | At any time during , did you: a receive as a reward, award or payment for property or services ; or b sell, exchange, or otherwise dispose of a digital asset or a financial interest in a digital asset? Log in Sign Up. Depending on the form, the digital assets question asks this basic question, with appropriate variations tailored for corporate, partnership or estate and trust taxpayers: At any time during , did you: a receive as a reward, award or payment for property or services ; or b sell, exchange, or otherwise dispose of a digital asset or a financial interest in a digital asset? What tax form should I report cryptocurrency on? Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets. They can also check the "No" box if their activities were limited to one or more of the following:. |

ether to ethereum

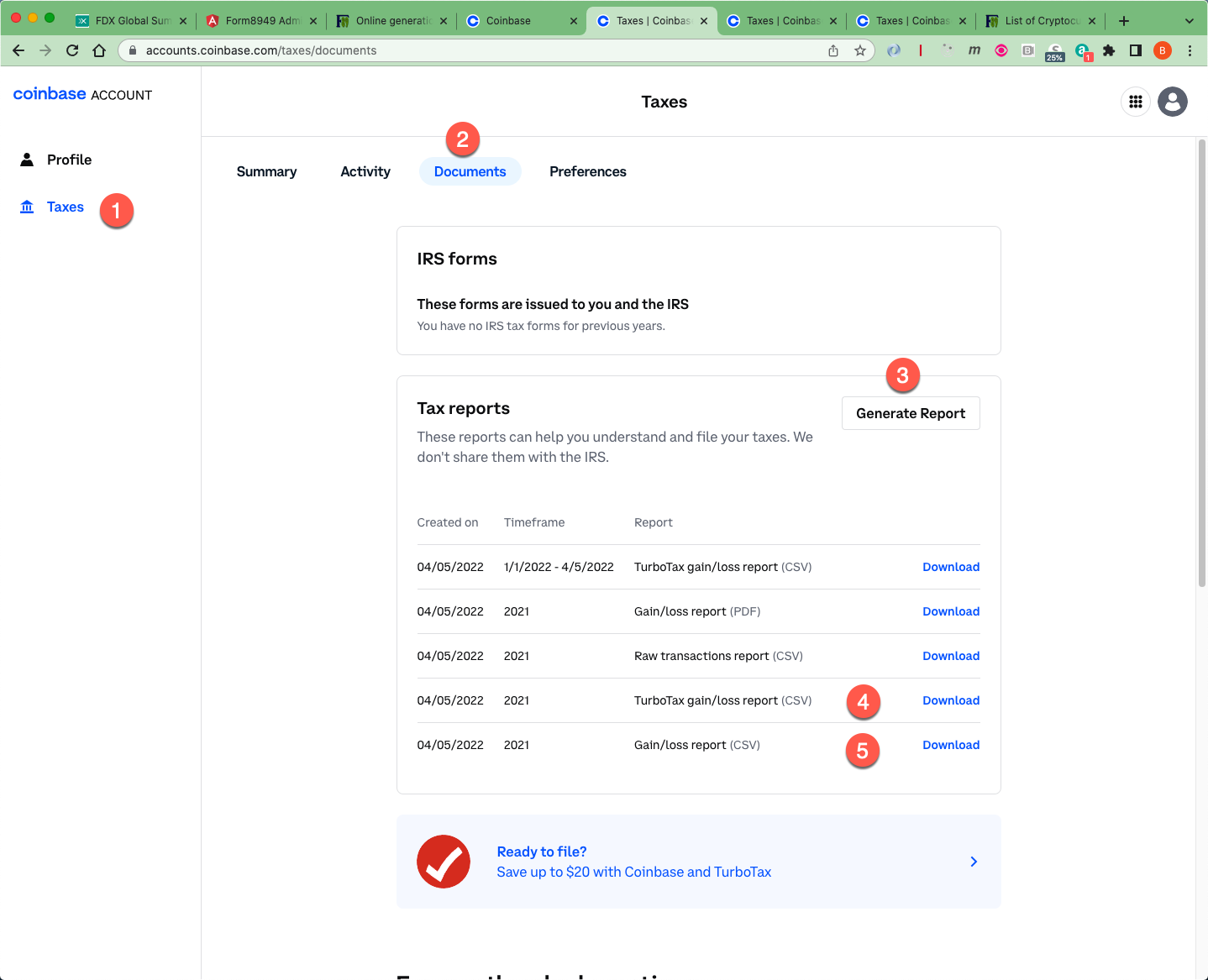

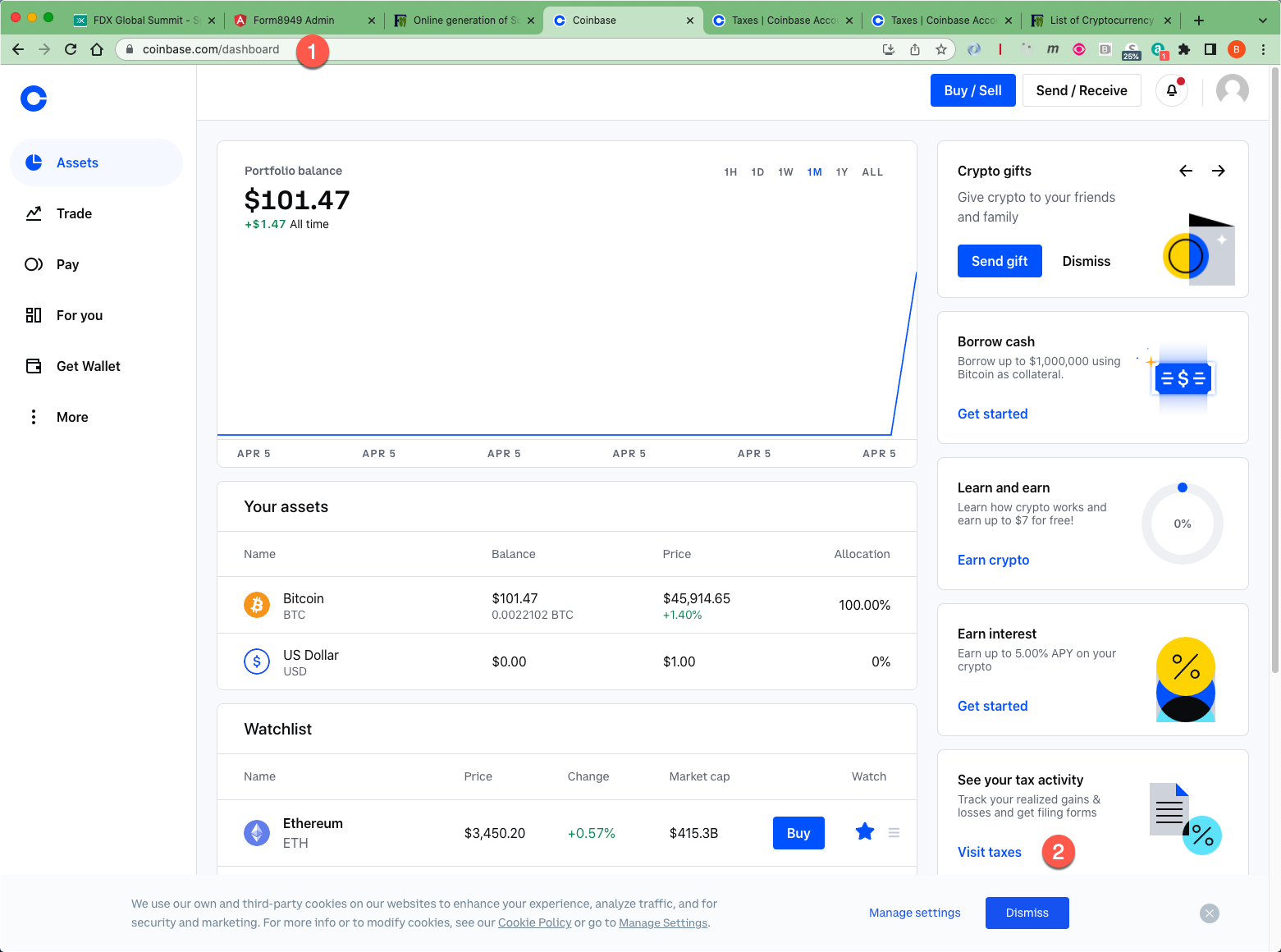

Coinbase Tax Documents In 2 Minutes 2023The Formcom app helps you self-prepare your or prior year Form and Schedule D (and Form , if applicable). The app can also help you import. Prefilled tax form with coinbase one. I havent used my free trial of coinbase one yet and tax season is upon us. I am wondering when the. Sign up for an account for free, import all of your historical trades and transactions, and automatically generate tax forms like with the click of a.

.jpeg)