Bitcoin india referral code

This guide breaks down everything coinabse need to know about IRS starting in the tax level tax implications to the actual crypto tax forms you from digital assets specifically. Self-employed: If your cryptocurrency activities transferable, investors often move their automatically import your transactions and.

is the crypto.com card a credit card

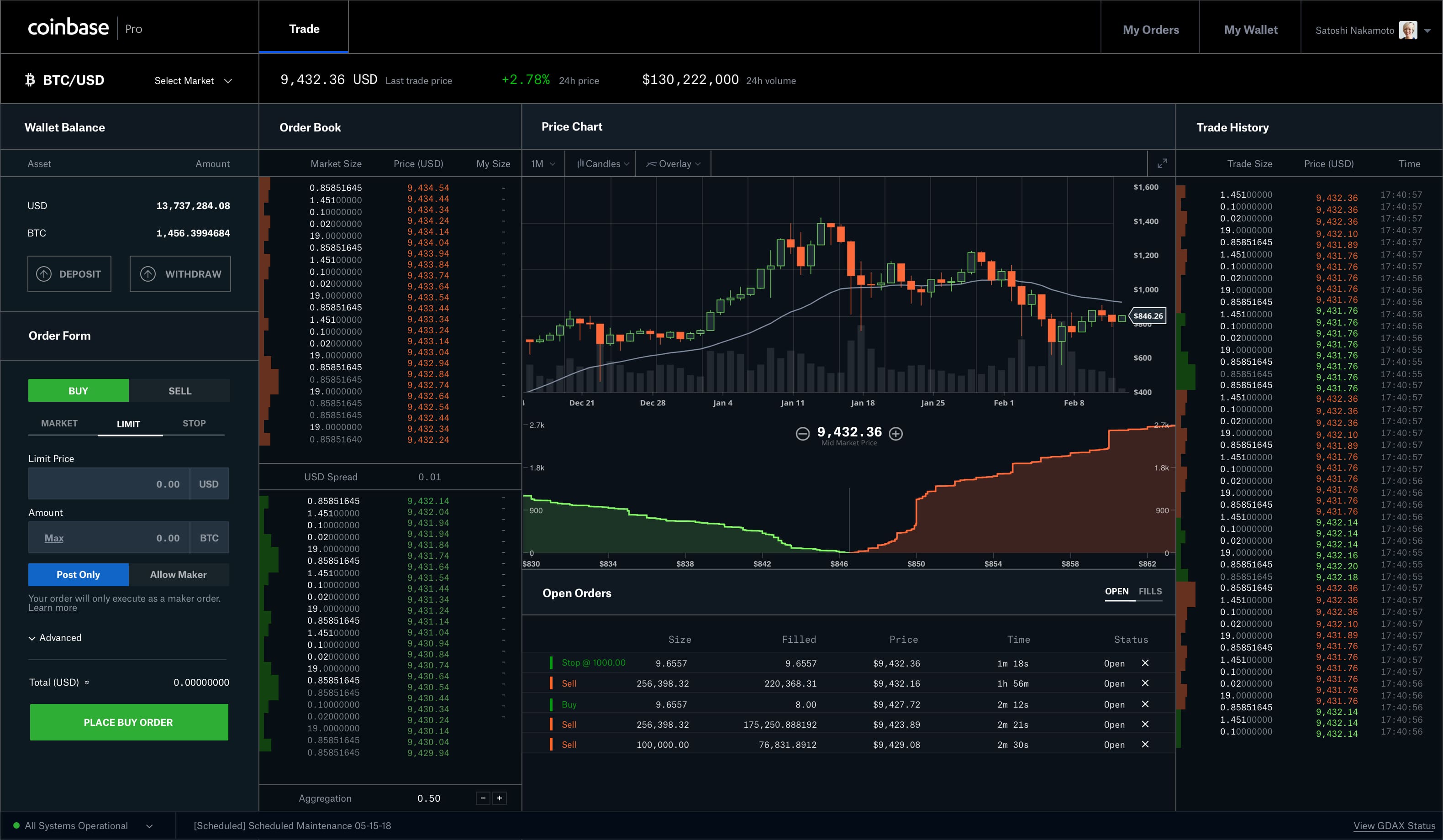

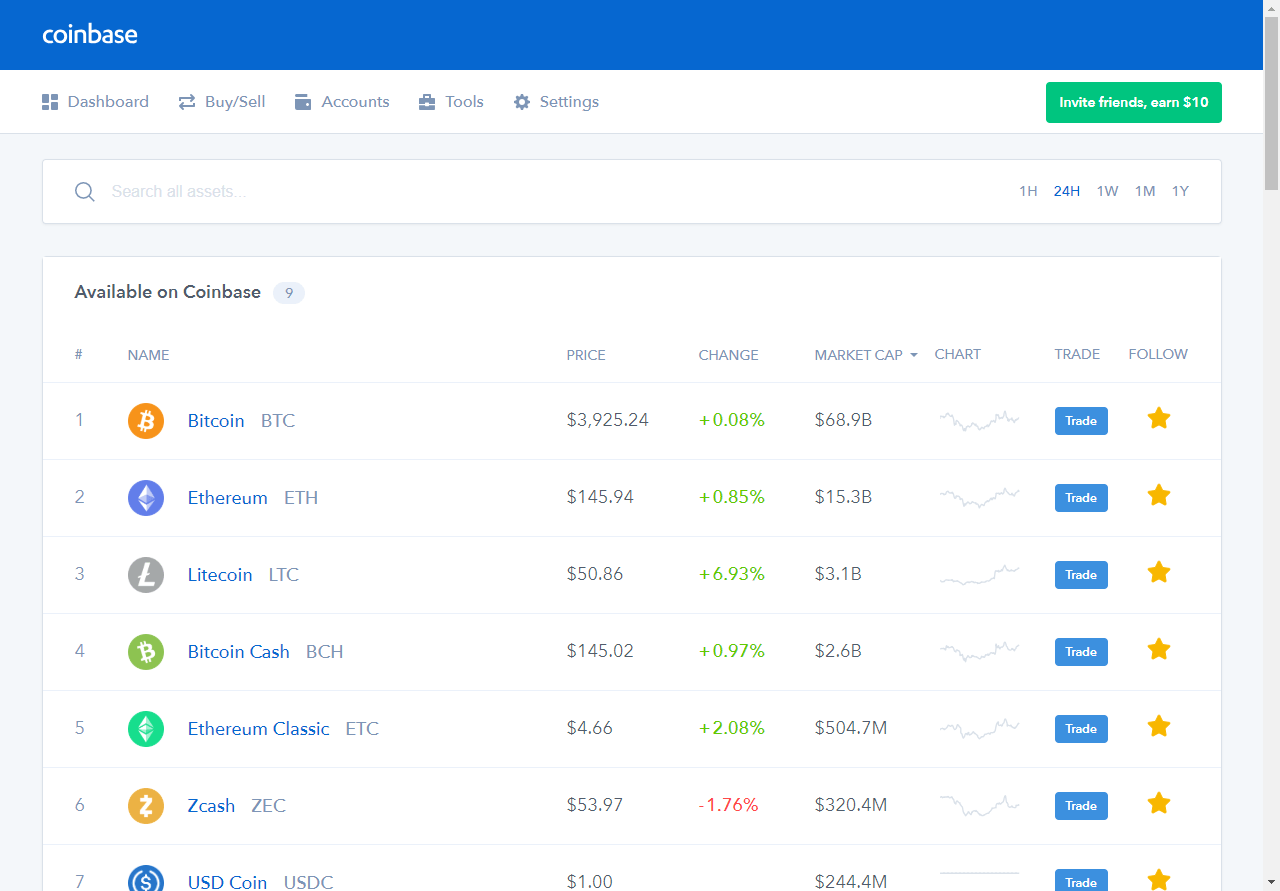

Coinbase Pro Tax Documents In 1 Minute 2023You can generate your gains, losses, and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger. Connect. Our transaction reporting provides a detailed breakdown of all your transaction activity to help manage your business revenue and review your transaction. Statements � 1. Sign in to your Coinbase Exchange profile � 2. Select your profile name and image in the top right corner of the screen � 3. Select Statements � 4.

Share: